Prime rents in London's West End have risen 4.6% over the year but are still 13% behind the 2007 peak. However, further positive rental growth is anticipated against a backdrop of limited supply and expected development completions in 2015.

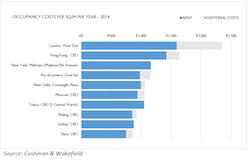

• London confirms its position as the world's most expensive office market for the third consecutive year

• Hong Kong ranks second for the second year in a row

• New York rounds out the top three, moving up two places

• Global rents rose 7% over the 12 months to December 2014

Cushman & Wakefield's head of London markets, George Roberts, said, "With a true global appeal, London continues to attract major international businesses looking to be based there, often using it as a springboard into Europe. As economic conditions in the UK further outperform, there will be heightened demand for London office space in 2015 from across all sectors. With supply heading downwards, further rental growth is expected."

Global office rents rose 7% in 2014, more than double the circa 3% annual compound increase since 2010. Overall, last year saw foundation cities from around the world reaffirm their position in the global hierarchy at the expense of smaller, peripheral markets.

Challenges remain for occupiers, not just in terms of property fundamentals, but also geopolitical risks which some are viewing with understandable caution. These factors are being leveraged by some occupiers to negotiate more flexible lease terms or lower rents, particularly in locations with oversupply. - See more at: http://www.worldpropertyjournal.com/real-estate-news/united-kingdom/london-real-estate-news/london-office-rental-rates-2015-most-expensive-office-markets-cushman-wakefield-annual-office-space-across-the-world-global-rankings-george-roberts-james-young-john-siu-8910.php#sthash.EuzlqXkr.dpuf